Trump Presidency: Data shows Nigeria received 5x more dollar inflows from United States under Trump versus Biden

The recent re-election of Donald Trump to the U.S. presidency, defeating Vice President Kamala Harris, has raised questions about how his policies might shape global investment flows over the coming years.

During Trump’s first term, Nigeria saw a substantial boost in foreign capital inflows, receiving five times more than it has under President Joe Biden’s administration.

According to data, Nigeria attracted a total of $10.5 billion in foreign capital during Trump’s first four years in office, compared to just $2.39 billion so far under Biden.

Analysts suggest that this disparity reflects the interplay of U.S. monetary policies, Nigeria’s interest rate strategy, and currency stability—factors that collectively created a more favourable investment climate during Trump’s tenure.

Comparative Capital Inflows: Trump vs. Biden

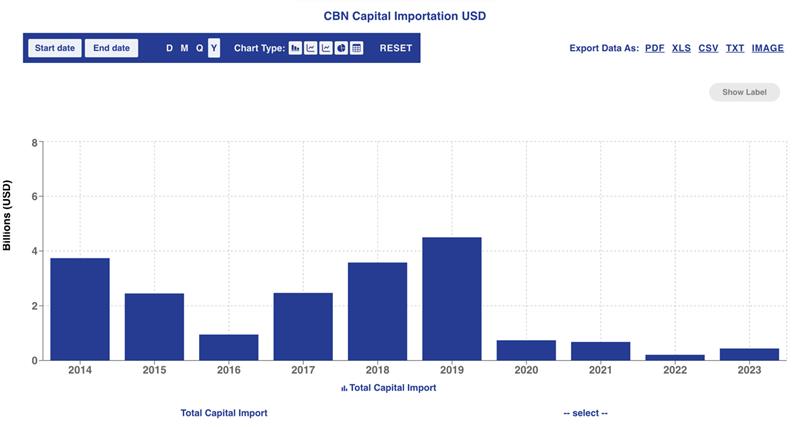

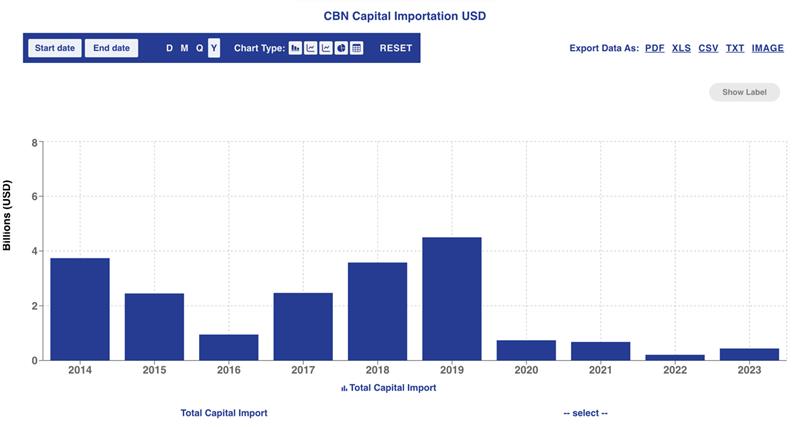

A closer look at the data reveals that under Trump’s administration, Nigeria’s capital inflows rose steadily, reflecting a favourable environment for foreign investment. The year-by-year breakdown of capital inflows shows this trend:

- 2016: $950 million

- 2017: $2.47 billion

- 2018: $3.58 billion

- 2019: $4.5 billion

By 2019, total capital inflows to Nigeria had hit a peak of $23 billion, with the United States alone contributing $4.5 billion. In contrast, under Biden, Nigeria has experienced a drastic reduction, attracting just $2.39 billion so far—roughly a quarter of what was achieved under Trump.

Key factors driving capital during Trump’s term

Interest Rate Policies: During Trump’s presidency, the U.S. maintained relatively low interest rates, making emerging markets like Nigeria more attractive to U.S. investors seeking higher returns.

- At the same time, Nigeria offered competitive interest rates, particularly between 2017 and 2018, to draw in foreign portfolio investment.

- Higher yields on Nigerian government securities during this period boosted investor interest and inflows.

Exchange Rate Stability: Another factor that underpinned Nigeria’s capital inflows was the relative stability of the naira.

- Between 2017 and 2019, the Central Bank of Nigeria (CBN) managed to keep the naira at around N360/$1, creating predictability for foreign investors concerned about currency risk.

- A stable currency is a significant consideration for investors, particularly in emerging markets, where currency depreciation can severely impact returns.

In the subsequent Biden years, the story shifted. With the U.S. Federal Reserve raising interest rates to combat inflation, many investors turned back to the U.S. for higher, safer returns.

This policy change, alongside a stronger dollar, led to a reduced appetite for riskier emerging market assets. Additionally, Nigeria faced increasing challenges in maintaining currency stability and faced significant depreciation pressures, which have made the investment environment less predictable.

Implications of Trump’s return to office

As Trump assumes office for a second term, the question arises: will Nigeria again see increased capital inflows?

If Trump reintroduces his prior policy stance of encouraging low interest rates, there may be an uptick in investor interest in emerging markets like Nigeria.

However, Nigeria’s ability to capitalize on this will also depend on its domestic economic policies, especially concerning exchange rate stability, inflation management, and a favourable interest rate regime.

Looking Forward: For Nigeria, Trump’s re-election presents a renewed opportunity to attract foreign capital. However, maximizing this potential requires careful alignment of domestic policies to create an investor-friendly climate.

Policymakers will need to focus on exchange rate stability, competitive interest rates, and continued reforms that enhance Nigeria’s global investment appeal.

Read more on what Trump’s election means for the Nigerian economy