Nigeria’s GDP falls farther from Tinubu’s $1 trillion economy dream on weak naira, low growth

Rocking his agbada on a Monday, October 23, 2023, at the 29th Nigeria Economic Summit in Abuja, the President of Nigeria, Bola Tinubu, told business leaders and Nigerians that Nigeria’s economy can grow to $1 trillion by 2026.

He added that a $3 trillion economy is possible in a decade with the assurance that his government can ensure “double-digit, inclusive, sustainable and competitive growth.”

However, a Professor of Development Economics at Babcock University, Prof Adegbemi Onakoya, said that this trillion-dollar economy for Nigeria “is not achievable, but it is an aspirational target. That is the stretch strategy.”

What does the GDP data say?

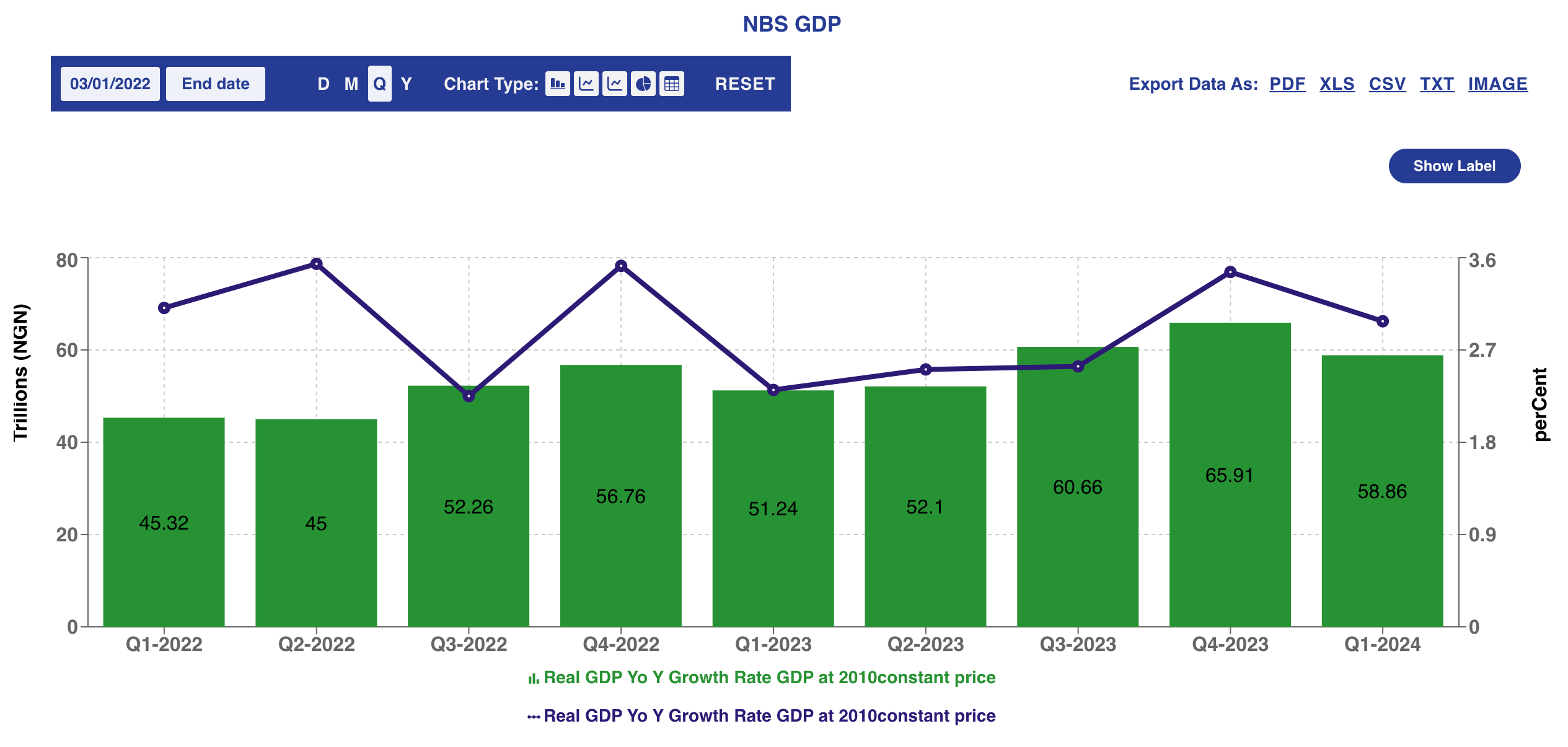

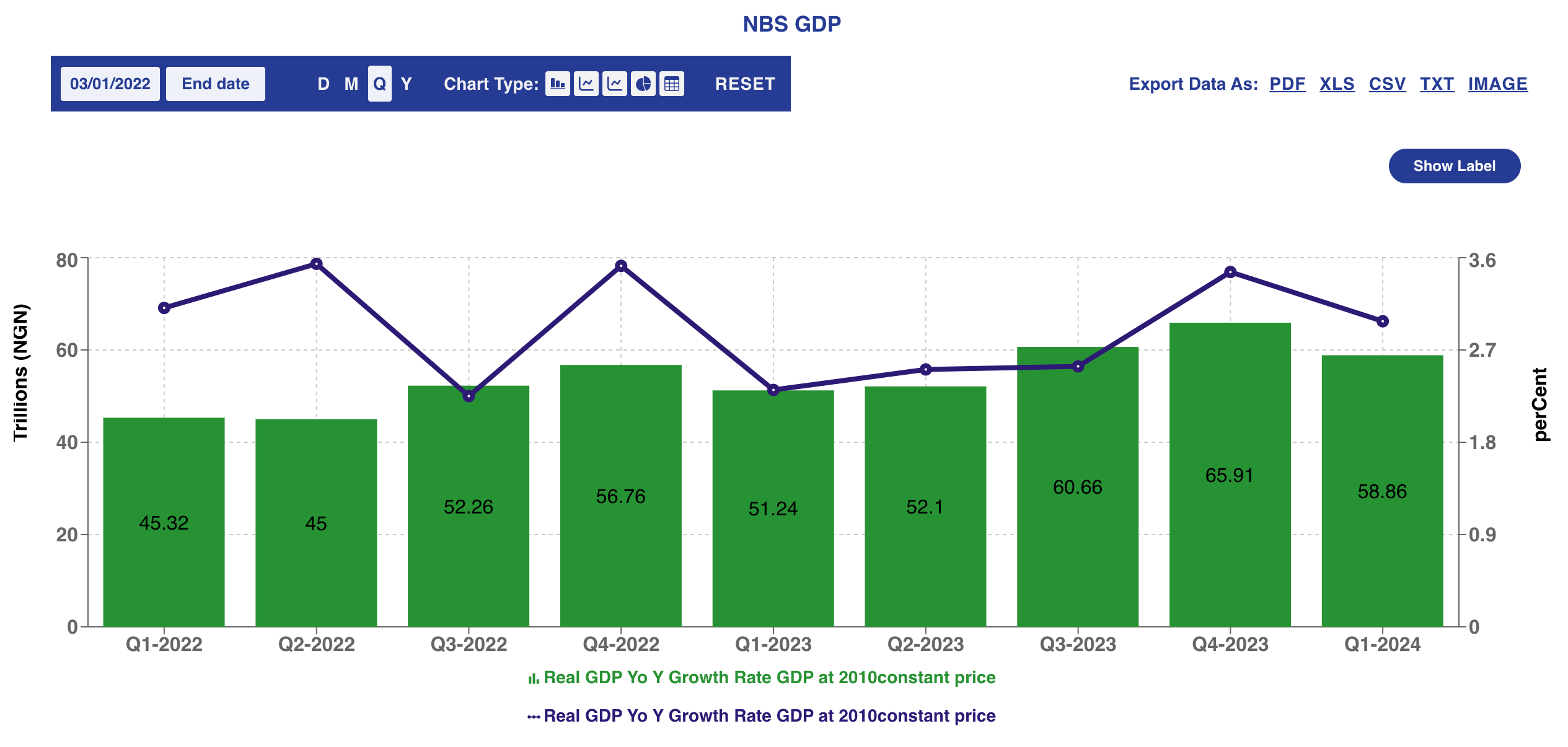

Nigeria’s Gross Domestic Product (GDP) growth declined to 2.98%, lower than the rate recorded in the fourth quarter of 2023 which was 3.46%, according to the latest report from the National Bureau of Statistics (NBS).

However, the GDP growth rate in the quarter is marginally higher than the figure recorded in the corresponding quarter of 2023 which was 2.31%.

The instability in the forex exchange market and the weakness of the naira pose a significant threat to Nigeria’s ambition of becoming a $1 trillion economy.

Analysis by Nairametrics shows that naira devaluation has triggered a loss of about $330.98 billion in the country’s GDP when converted from naira to dollar.

Our analysis reveals that the country amassed a total GDP of N237.53 trillion for the year-long period from Q2 2023 to Q1 2024 in nominal terms.

Converted to U.S. dollars at the exchange rate on the website of the Central Bank of Nigeria (CBN) at the end of March 2024 (N1,303.84/$1, Nigeria’s GDP stands at approximately $182.18 billion.

However, using the exchange rate before the FX unification policy of about $462.88/$, Nigeria’s GDP would have been at approximately $513.16 billion.

Aside from a decline in dollar terms, a decrease was also observed in the quarterly naira value of the country’s GDP.

It dropped to N58.86 trillion in Q1 2024, which is lower than the value in Q4 2023 (N65.91 trillion) but higher than Q1 2023 (N51.24 trillion).

For Nigeria to hit the $1 trillion economy by 2026 at a GDP of N237.53 trillion, naira must appreciate to N237.53/$ which is highly unlikely given the current macroeconomic conditions.

The current exchange rate, however, implies that Nigeria’s economy will need to quadruple in growth over the next three years if it is to reach $1 trillion in GDP.

That is, assuming, of course, the exchange rate remains unchanged, which is highly improbable.

The International Monetary Fund (IMF) expects Nigeria’s GDP to be $253 billion in 2024, becoming the fourth largest economy in Africa due to naira devaluation.

The rebasing hope

Rebasing the economy, as the NBS did in 2014, is another possible means by which it could get closer to the $1 trillion economy dream.

Nigeria became the biggest African economy in 2014 (surpassing South Africa) by rebasing GDP, going from $270 billion to $510 billion.

Economists have argued that the economy needs to be rebased because the economy’s form has evolved and the existing method of calculating GDP may not be reflecting its true size, particularly in areas such as healthcare, real estate, fintech, and trade.

The NBS has begun the process of rebasing Nigeria’s GDP and Consumer Prices Index (CPI) estimates. This exercise, recommended by the United Nations Statistical Commission to be carried out every five years, aims to reflect updated economic conditions.

Justifying the need for the rebasing, Former Chief Executive of National Planning, Ode Ojowu, said that since the last rebasing in 2014, Nigeria has experienced significant structural changes in various sectors.

These include the rapid growth of technology and digital sectors, such as fintech, e-commerce, and digital services.

Additionally, the agricultural sector has seen the emergence of new value chains, including agribusiness, processing, commodity exchanges, and export activities, as well as the growth of renewable energy sources like solar power.

Speaking with Nairametrics, the Chief Executive Officer, Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf said that the rebasing will provide “a clearer picture” of the true value of Nigeria’s GDP.

However, the Director of Research and Strategy at Chapel Hill Denham, Tajudeen Ibrahim, told Nairametrics: “Rebasing the GDP is good, but it is not necessarily what can take us there very quickly. What we are just doing is recapturing the existing activities. We are not creating new economic activities, which is what I believe is important in this case.”

Government’s recent efforts

The CBN recently increased the capital base for commercial banks with international authorization to N500 billion and national banks to N200 billion. The new capital requirement will consist solely of paid-up capital and share premium. The CBN also emphasized that all banks are required to meet the minimum capital requirement within 24 months commencing from April 1, 2024, and terminating on March 31, 2026. The recapitalization would strengthen banks’ role in the envisaged $1 trillion economy, according to the CBN governor, Yemi Cardoso.

However, some analysts said this move may not be enough to hit the ambitious 2026 economic goal.

The National Assembly plans to push the CBN’s capital base to N1 trillion based on the proposed amendments to the CBN Act of 2007. The move is to ensure that the CBN remains a formidable pillar in Nigeria’s economic landscape.

What can be done differently?

While admitting that there is a slim chance of Nigeria hitting the $1 trillion economy in the near term, Ibrahim stressed the need to address fundamental issues in the country.

He said: “I think the chances of achieving a $1 trillion economy is very slim based on the volatility in the exchange rate that we have seen so far and based on the fact that we are considering short-term solutions to our exchange rate challenges. It does not look to me like we are considering long-term sustainable solutions. That is why there is little or no conviction that over the next seven years of the current administration, it does not look like we will achieve a $1 trillion economy.

“But if we can fix our challenges by addressing the fundamental issues that have been the major challenges, then we can be talking about the relative stability of the currency over the medium to long term. By then, we can be thinking or talking about something that is even more than the $1 trillion economy in terms of size.”

For Prof Onakoya, the government needs to leverage the oil and gas sector as well as the solid mineral sector.

He said: “What can government is to locally increase output, especially in the oil and gas sector. Intensifying the harvesting of value in the solid mineral sector because that is where the money is. We are endowed with all mineral resources you can speak about in Nigeria. The government should ensure that the sector is organised, and the money being realized is not going into public pocket.”

The development economist also stressed that the government could make “nothing less than $200 billion” from mining lithium, adding that the government should also strengthen the agriculture sector for the country to be able to feed itself.

Too soon to judge?

However, Prof Onakoya concluded that for any economic policy to be sustainable, it takes not less than three years, adding that it appears that the current administration is in the right direction.

It is hoped that the recent reforms, especially by the CBN, will eventually strengthen the struggling naira against the dollar, and boost Nigeria’s GDP in dollar terms.

However, the government still has to play a significant role on the fiscal side to drive economic growth, which is currently threatened by insecurity, persistent inflation and hike in interest rates, among others.