Nigeria’s foreign debt service costs surge by 96% to $2.19 billion by May 2024

Nigeria has seen a significant surge in its foreign debt servicing costs, with an increase of 96% year-on-year, according to the latest data released by the Central Bank of Nigeria (CBN).

By the end of May 2024, the country’s debt services and payments had reached $2.19 billion, a sharp rise from $1.12 billion recorded in the same period in 2023.

The cumulative foreign debt servicing costs for the first five months of 2024 amounted to $2.19 billion, nearly doubling the amount spent in the same period in 2023.

It is also about 84% of the total external debt servicing costs recorded in 2022, which was $2.6 billion.

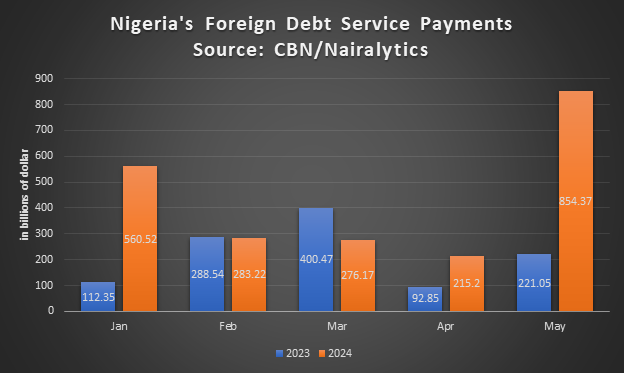

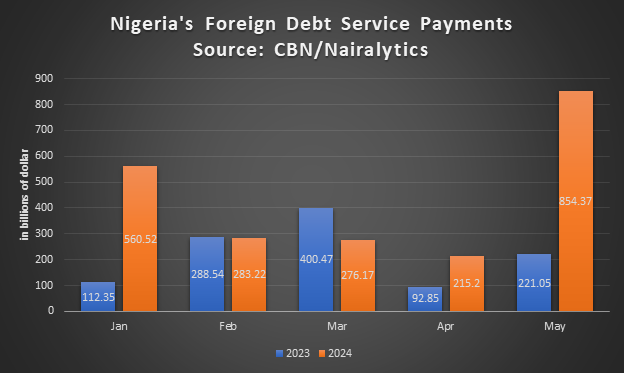

Breakdown of Foreign Debt Service Payments

- In January 2024, Nigeria’s debt servicing costs amounted to $560.52 million, an increase of 399% compared to $112.35 million in January 2023. This significant jump underscores the growing burden of external debt on the country’s finances.

- February 2024 saw a slight decrease in debt servicing costs, totalling $283.22 million. This is a 1.8% decline from $288.54 million in February 2023. Despite the minor decrease, the overall trend indicates a steep rise in debt costs.

- In March 2024, debt payments were recorded at $276.17 million, a 31% decrease from $400.47 million in March 2023. This reduction suggests a temporary reprieve in the upward trend of debt servicing costs.

- However, April 2024 witnessed a substantial increase in debt servicing payments, which rose to $215.20 million from $92.85 million in April 2023. This marks a 132% increase year-on-year, reflecting the escalating debt obligations of the country.

- The month of May 2024 saw a further spike in debt servicing costs, reaching $854.37 million compared to $221.05 million in May 2023. This represents a significant 286% increase, highlighting the growing fiscal pressure on Nigeria’s economy.

Debt service gulps 66% of official dollar outflow

Nairametrics further observed that Nigeria spent about 66% of its dollar payments to service external debts between January and May 2024.

According to data from the CBN, out of the $3.31 billion in total outflows made during this period, about of $2.19 billion was directed towards servicing external debt.

This figure represents a hefty slice of the nation’s financial resources and indicates a significant increase from the previous year when it was 44% in the same period.

More Insights

The soaring costs of servicing foreign debt have significant implications for Nigeria’s economy. The increased debt burden could potentially divert resources away from critical sectors such as healthcare, education, and infrastructure, exacerbating socio-economic challenges.

The World Bank recently expressed deep concern over the escalating debt service costs that are burdening developing countries worldwide. Indermit Gill, the World Bank’s Chief Economist, and Senior Vice President, emphasized the gravity of the situation, highlighting the potential for a widespread financial crisis if immediate and coordinated actions are not taken.

According to Gill, the combination of record-level debt and soaring interest rates has set many developing nations on a precarious path, one that could lead to economic distress and tough decisions regarding the allocation of resources.

Fitch Ratings recently noted that pressure on interest-to-revenue ratios remains high at 38%, driven by higher interest rates and structurally low revenue-to-GDP ratios.

The rating agency also projected a decline in Nigeria’s debt costs, although they are expected to remain significantly high.

The Nigerian government needs to adopt more stringent fiscal measures and explore debt restructuring options to mitigate the impact of rising debt servicing costs.

Enhanced revenue generation strategies and prudent economic management will be crucial in addressing the growing debt burden.